Getting Started With THS

Step 1-Install

Step 2-Import/Add Taxpayers

Step 4-Start Using THS

FAQ Section

Extended Getting Started Video (1 hour)

This video is almost an hour. This video covers the basics of getting started with THS. Currently we are breaking this video down into smaller pieces to make it easier to consume. This video was recorded in 2020 and there have been some changes to the IRS Login and transcript downloading process in that time.

What do I need to download transcripts from the IRS?

In order for a tax pro to be able to obtain transcripts on their taxpayers behalf they must have CAF Authority. The primary way to achieve that is having the taxpayer sign an 8821 or 2848 authorizing the tax pro to have access to their data. The 8821 or 8821 is then faxed or uploaded to the IRS for processing. Processing times can be several weeks during the COVID crisis.

We have recorded 2 webinars on 2848/8821 linked below:

Pt1 How to complete a 2848/8821

Pt2 How to submit 8821/2848

Manual Login Method Tutorial

Auto Login Tutorial

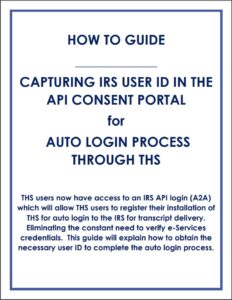

Video Coming Soon. We currently have provided PDF Instructions to set up the Auto Login Method in THS:

Click the image to download or use this link: https://taxhelpsoftware.com/Downloads/A2A_Instructions.pdf

I forgot or Lost My AUto Login UID

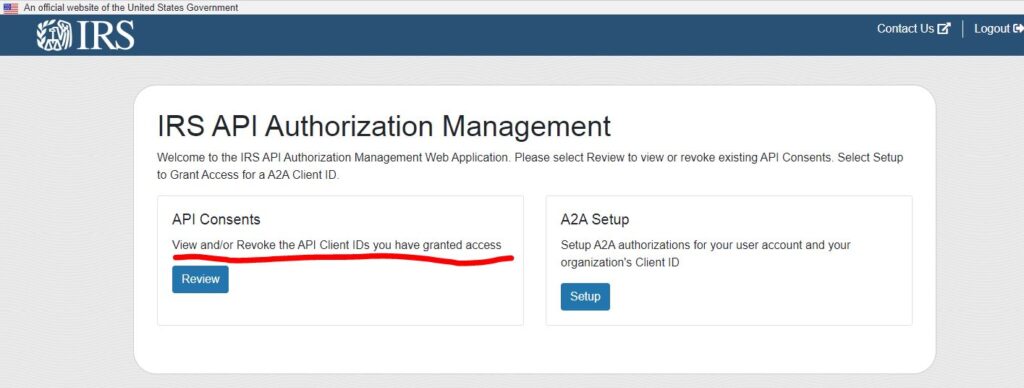

- Use these instructions (https://la.www4.irs.gov/esrv/consent/), but on Step 3 select API Consents and revoke your Consent.

- Once revoked navigate back to the Step 3 page and follow the PDF instructions.

- Basically you are just revoking and asking for consent again. The UID does not change, but each Organization on your Select Organization screen during login will have a different UID. Not all UIDs have transcript delivery access. If once you put your UID into THS and you cannot get transcripts you may have selected an Organization that does not have access.