Support/FAQ

Create A THS Support Ticket

90% of all issues can be resolved by reviewing the FAQs on this page. Support tickets will be answered in the order received. Our goal is to have most support issues resolved on the same business day.

THS Program User Manual

FAQ

401 Unauthorized Access Error in transcript request

- This error indicates there is an issue with your EFIN.

- In order to access e-Services a tax pro needs to operate under an EFIN.

- The user can either be the principal on the EFIN or a Delegated User.

- Every May the IRS purges EFINs that do not file returns. The issue is the IRS allows EA, CPA and Attorneys to access e-Services with an EFIN that does not file returns, but the EFIN unit does not check before cancelling the EFIN.

Instructions to fix this error is as follows:

- Log into the IRS:

- Check the status of your EFIN by logging in here (Select Individual on Organization Page to see all EFINS): https://la.www4.irs.gov/esrv/esam/pages/landingPage.xhtml You will need to click the edit (eyeball icon) and click on EFIN status to see your status. If it is inactive they will reactivate if it is cancelled you will need to re-apply which can take weeks. Fix is below.

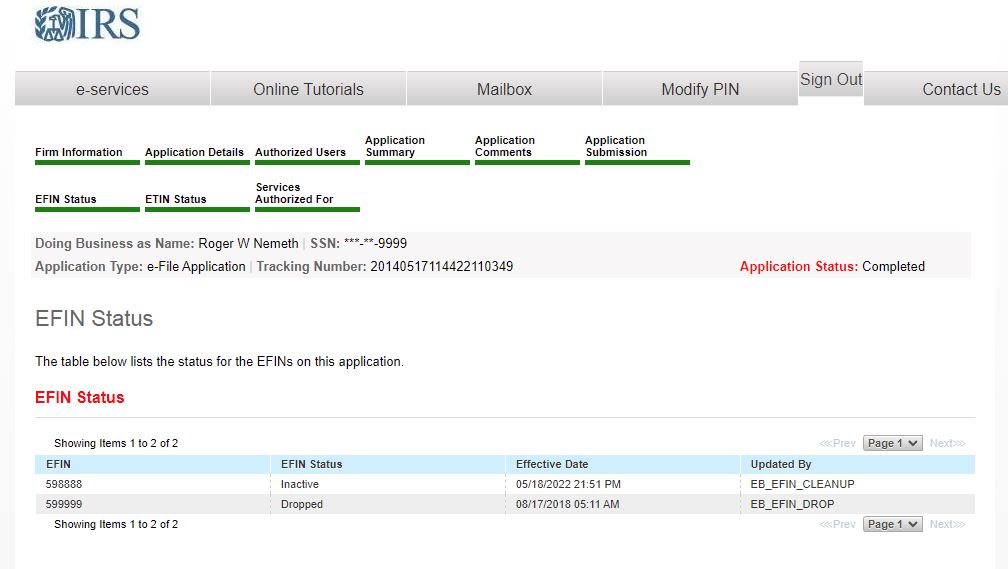

- Here is an example when the IRS cancelled mine. They call it drop. They have actually done it twice once in 2018 and one in 2022

- To fix you can switch to another EFIN that has not been dropped OR…

- Call e-Help Desk (has to be the Principal or Responsible Party listed on EFIN. Delegated Users cannot call.

- After it is reactivated you may need to re-setup THS login process because the EFIN probably changed and requires this.

IRS is blocking my requests? (403 Error)

The IRS uses a firewall service named Akamai that occasionally blocks an IP from IRS.gov. These blocks usually last anywhere from a couple of minutes to 24 hours.

The IRS has advised logging in multiple times with the same set of credential simultaneously can cause it. This is not always the case sometimes it is unknown what triggers the block. The IRS has advised it is not caused by THS interacting with the API.

THS now has an autologin method that bypasses the Akamai firewall and has less issues. This is the method the IRS recommended we use.

The initial program install or update fails

99% of the time if the program fails to install or the update fails it is caused by the antivirus or firewall on the users computer. Try temporarily disabling the software and trying again. Occasionally, a system file needs to be renamed after the uninstall. go to C:\Users\”your user profile”\AppData\LocalIf that does not work contact us 404-910-3605 or support@AuditDetective.com. This error often looks like this (or similar):

Why do I need access to E-Services in order to use THS products?

Currently, all the Tax Help Software products access Tax Transcripts through the IRS E-Services Portal. For the network version non e-Service users can access the program. When setting the the program password select the checkbox for non e-Service users.

How to White List THS exe files to Antivirus?

- CMS.exe

- ADTranscriptUploader.exe

- THSReportProcessor.exe

- THSRequester.exe

CAF check always fails?

99% of the time this indicates the CAF number was improperly input when setting up the system. Please follow these steps carefully to rectify the issue.

- Please call the IRS Priority Practitioner Service at 866-860-4259 and confirm your CAF Number and that your 2848 or 8821 has been processed. It usually takes 3-5 business days for 2848/8821 acceptance. Also, be aware need the CAF number assigned to the tax professional. CAF’s assigned to businesses cannot be used with the Transcript Delivery System.

- PLEASE DO NOT SKIP STEP 1. Many users skip this step because they are positive they know their CAF number because they have used it for years. The IRS does on occasion change CAF numbers especially when there has been a name change. Also, just because you have been putting this CAF number on 2848/8821 forms and getting transcripts via fax does not mean it is correct. The IRS does not input your CAF number into the system when entering 2848/8821 forms. It populates automatically when they bring you up in their system by name and enrollment number (or CPA/Attorney number).

- Log into E-Services directly and request a transcript using the verified CAF number. Request at least one transcript for someone you know you have a 2848/8821 Form processed. If it does not pass the CAF Check and you followed Steps 1 & 2 please call us at 404-910-3605.

- To re-enter your CAF into the THS program just click on the “Update E-Service Info” button on the login screen. Enter your Username, password, and CAF number and then select “OK” if you already have an Organization selected (if not retrieve your organizations and select the proper one).

- Request a CAF Check or a transcript request. Once you have one successful request your CAF is verified.

- The CAF number does not have a direct contact number but the IRS does have IRS Stakeholder Liaisons that can help if there is an issue with your CAF. Click Here for their contact info.

The license Hardware ID does not match the machine Hardware ID.

Please complete a support ticket at the top of this page and include your license number (this is a bunch of random letters separated by hyphens and explain you got the hardware ID message and we will reset your license.

This occurs when the license is being installed multiple times or the hardware on the original machine has changed.

THS Printer will not install when running reports.

If you get an error stating unable to install THS Printer run the manual install at the following link:

I receive a CAF Check Passed – ID Theft indicator?

This indicates that there is an ID Theft Indicator on the account. When an ID Theft Indicator exists there is no way to download the transcripts electronically. You can call the IRS ID Theft Protection Unit and request them via fax under POA, 8821, or have the client call directly. The number is: 800-908-4490

I do not know what a CAF number is?

A CAF number is required by the IRS to use the IRS Transcript Delivery System (TDS). If you do not have a CAF number check out the e-Services FAQ also on this page.

A CAF number is a unique nine-digit identification number and is assigned the first time you file a third party authorization with IRS. A letter is sent to you informing you of your assigned CAF number. Use your assigned CAF number on all future authorizations.

CAF numbers are different from the third party’s TIN (Taxpayer Identification Number), EIN (Employer Identification Number) or PTIN (Preparer Identification Number). CAF numbers may be assigned to an individual or a business entity.

If you are a tax professional and cannot remember your CAF number, you may call the Practitioner Priority Service, otherwise known as PPS. PPS may be reached at 866-860-4259. A PPS assistor will initiate the process to help you retrieve your CAF number once you provide your authenticating information.

Webroot Endpoint AV Issues

2 Issues

- In November 2022 THS users using Webroot Endpoint Anti-Virus started reporting their computer was crashing and rebooting or BSOD when attempting to download transcripts. The issue was identified as a corrupt Webroot file that was crashing the computer when it was monitoring THS. The corrupt Webroot file C:\Windows\System32\drivers\WRkrn.sys Users reported their are multiple fixes on the Webroot support pages. Some reported if they rename or replace the file it fixes the issue. This is a system file so we recommend checking with Webroot support.

- The second issue with Webroot is that it is locking transcripts and batch files during transcript downloads causing THS to have errors indicated by a “this file is locked by another process”. We are not sure what the fix is yet but Webroot should not be locking files. Current recommendation is to reach out to Webroot support.

What Do You Need To Use THS

(and the IRS E-Services Transcript Delivery System)

The criteria to request IRS transcripts through THS or the IRS Transcript Delivery System are the same. You need IRS E-Services Login Account, access to an IRS E-File Identification Number (EFIN), A CAF Number and Permission from the Taxpayer.

How can I register for e-Services and access to the Transcript Delivery System (TDS)?

Once you sign up for an e-Services Account (see instructions above) register for an EFIN (Alternatively an EFIN holder can assign you as a Delegated User. See instructions below):

- Log into e-Services:Click Here

- Click on “New Application” –> “e-File Application”

- If you are an EA, CPA or Tax Attorney who does not file tax returns select Business Type = Sole Proprietorship NO to the Do you have an EIN Question (Answer no even if your company has an EIN. You are signing up as an individual. If you sign up under an EIN you must have 5 E-Filed returns for any tax year.)

- Complete the rest of the application and make sure you submit it at the end with your PIN from your e-Service Account.

- Check back in e-Services once a week to check the application status (you will wait an extra couple of weeks if you wait for the letter in the mail). This process can take 1 week after tax season and 4-6 weeks at the start of tax season.

- You will not be able to submit the application until you confirm your e-Service Account when first signing up for e-Services.

- Any issues call IRS e-Help Desk 866-255-0654 or THS at 404-910-3605. We are happy to help.

What is e-Services and the Transcript Delivery System?

Who can access the IRS Transcript Delivery System (TDS)?

- Enrolled Agents

- CPA’s

- Attorneys

- Any tax professional who has an EFIN with at least 5 E-Filed tax returns.

- Be an assigned Delegated User of an entity or individual who has access. See the instructions on this page.

How to recover a lost or forgotten E-Services Password?

Follow these steps:

- Go to: https://la.www4.irs.gov/esrv/tds/

- Enter your username and submit.

- Click on Forgot Password and follow the instructions.

How can I verify if I have access to the Transcript Delivery System (TDS)?

There are 2 ways to verify access to the Transcript Delivery System:

- Login to e-Services. Select the organization you believe has access. On the main e-Services page you should see a link for the Transcript Delivery System. If you see it you have access.

- Call the IRS e-Help Desk (1-866-255-0654) and ask them if you have access.

Many times individuals should have access to the Transcript Delivery System but it is not turned on in the IRS system. If you should have access the IRS e-Help Desk can assist you with getting it activated.

How do I assign a Delegated User?

Tax professionals who have an EFIN can grant access to IRS Transcript Delivery System (TDS) to their employees as designated users. Designated Users can not get transcripts for the EFIN holder’s CAF number. The delegated users have to be listed on the 2848/8821 with their own CAF number.If an 8821 is submitted under the firms CAF number Delegated Users can request transcripts over the phone through PPL and have them placed in their SOR mailbox, but they can not access them directly through TDS.

To assign a Delegated User:

- Log into e-Services e-Application portal: https://la.www4.irs.gov/esrv/esam/pages/landingPage.xhtml

- Once logged in select the EFIN to add the Delegated User.

- Select “Authorized Users” and select “Add New”.

- Enter the Delegated User’s info and then follow the steps to save and submit.

Getting Started With e-Services (Archived Webinar)

EFIN Access or Delegated User

CAF Number

Taxpayer Permission

Getting Started With THS

Step 1-Install

Step 2-Import/Add Taxpayers

Step 4-Start Using THS

FAQ Section

Extended Getting Started Video (1 hour)

This video is almost an hour. This video covers the basics of getting started with THS. Currently we are breaking this video down into smaller pieces to make it easier to consume. This video was recorded in 2020 and there have been some changes to the IRS Login and transcript downloading process in that time.

What do I need to download transcripts from the IRS?

In order for a tax pro to be able to obtain transcripts on their taxpayers behalf they must have CAF Authority. The primary way to achieve that is having the taxpayer sign an 8821 or 2848 authorizing the tax pro to have access to their data. The 8821 or 8821 is then faxed or uploaded to the IRS for processing. Processing times can be several weeks during the COVID crisis.

We have recorded 2 webinars on 2848/8821 linked below:

Pt1 How to complete a 2848/8821

Pt2 How to submit 8821/2848

Manual Login Method Tutorial

Auto Login Tutorial

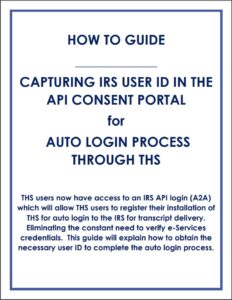

Video Coming Soon. We currently have provided PDF Instructions to set up the Auto Login Method in THS:

Click the image to download or use this link: https://taxhelpsoftware.com/Downloads/A2A_Instructions.pdf

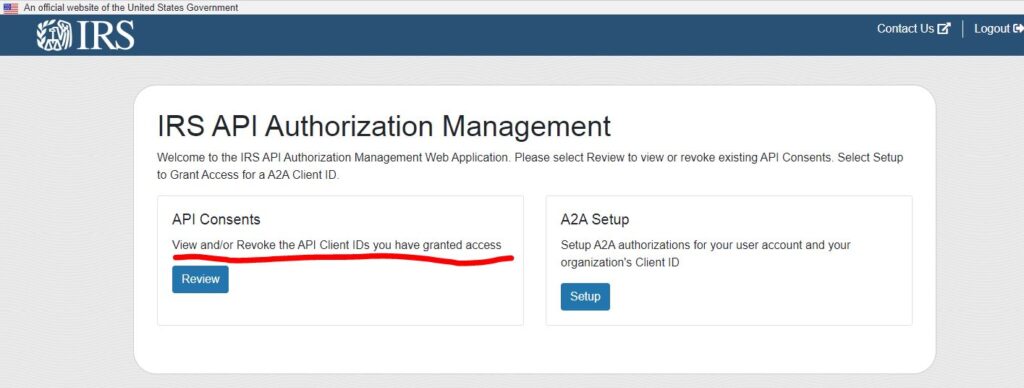

I forgot or Lost My AUto Login UID

- Use these instructions (https://la.www4.irs.gov/esrv/consent/), but on Step 3 select API Consents and revoke your Consent.

- Once revoked navigate back to the Step 3 page and follow the PDF instructions.

- Basically you are just revoking and asking for consent again. The UID does not change, but each Organization on your Select Organization screen during login will have a different UID. Not all UIDs have transcript delivery access. If once you put your UID into THS and you cannot get transcripts you may have selected an Organization that does not have access.

IRS Transcript Management System

The original program that requests, downloads, and analyzes IRS Transcript Data to find opportunities and issues with your client’s taxes.