THS CoPilot Program

What is the THS CoPilot Program?

THS CoPilot is a free program for THS users that aims to show users of all skill levels how to monetize THS during tax season. Roger Nemeth the inventor of THS will show you how he would use the program if he was managing a tax office.

The resources on this page include marketing materials, short concise tutorial videos with instructions, sign up for e-mail reminders.

Archived Videos are at the bottom of this page

Setting Up THS To Participate In THS CoPilot

Sign Up For E-Mail Best Practices and Tips

We will no longer send weekly email reminders due to spam filters blocking many of them. Instead we will send periodic updates and best practice tips.

View CoPilot Calendar

You can add this THS CoPilot Calendar to your calendar and set your own reminders and notifications.

The Calendar ID: c_pti4uuhbmufs0tdd4casonof6o@group.calendar.google.com

The Calendar URL: https://calendar.google.com/calendar/embed?src=c_cdf64ec7eb7a36da73647e7224fc42b96715664a4fd0383aa05760151a4ac5d7%40group.calendar.google.com&ctz=America%2FNew_York

Depending on your calendar provider you can Google “How to import a Google Calendar” for specific instructions.

Selling IRS Account Monitoring (Including Marketing Materials)

Instructions (Video Coming Soon):

- THS Main Dashboard

- Click on Tools–>Audit Tracking

Alternatively you can use this PDF template and set the price and expiration date and print them in bulk to fill out each clients name by hand:

Fillable IRS Account Tracking Product (PDF)

Marketing Flyers (PDF):

Customizeable IRS Account Monitoring Desktop Flyer – 1.pdf

Customizeable IRS Account Monitoring Desktop Flyer – 2.pdf

Marketing Flyers (Microsoft Publisher):

IRS Account Monitoring Desktop Flyer – 1.pub

IRS Account Monitoring Desktop Flyer – 2.pub

Acrylic Desktop Marketing Stands for Flyers on Amazon:

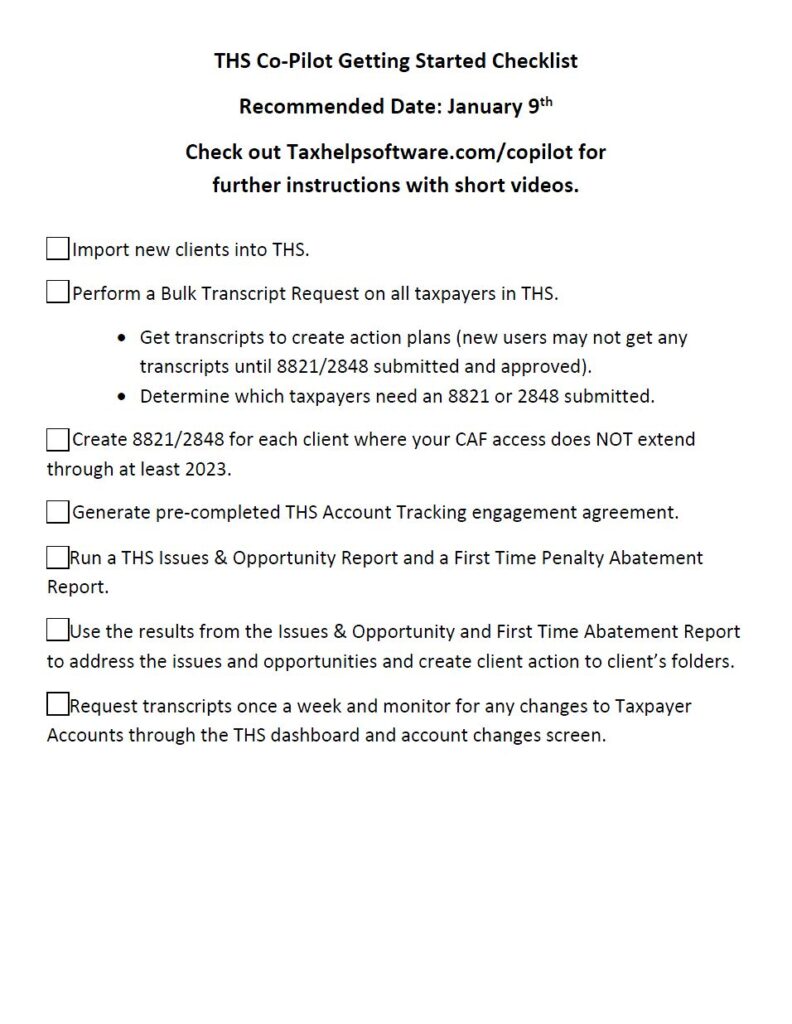

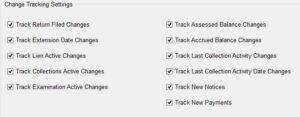

Check For CAF and Check For Expiring 8821/2848

Instructions: (see video below)

- Perform a bulk transcript request for all transcripts.

- Once THS imports the data check the column “CAF Passed”. If it shows “yes” you have CAF for at least one year.

- Next check the column “Current Yr CAF Passed”. If this shows “yes” your 8821 or 2848 is good through at least this calendar year.

- If “CAF Passed” shows “yes” and “Current Yr CAF Passed” shows “no” that means you have CAF but not for the current calendar year and you should submit a new 8821 or 2848.

Bulk Create 8821/2848 & Submission Best Practices

Instructions (Video Below):

- Batch Update–>Select Taxpayers–>Action To Perform at top–>Generate 8821 (alternatively 2848 if you are advanced and know the difference)–>Go

- There are 2 one hour long webinars at the bottom of these instructions. Pt 1 explains how to complete the forms and the differences. Pt 2 explains the best practice for submitting them.

- WARNING!!! When creating 8821 or 2848 in THS the user is responsible for making sure all the required fields are included. Different tax pros believe different fields are required. The Pt 1 webinar video below explains which fields are required.

How To Bulk Create 8821 for CoPilot.

2848 and 8821 Part 1 How To Complete Forms (1 hr)

2848 and 8821 Part 2 How To Submit Forms (1 hr)

Create a Customized THS CoPilot Dashboard For Monitoring

Instructions (see video demo below):

THS Main Dashboard–>click Monitoring View under selected view towards top of screen–>Set as default and move the columns to desired position.

Bulk Request Transcripts

Bulk Transcript Request

THS Main Dashboard–>Bulk Transcript Request–>Select All–>Execute

Change Transcript Default Requests

THS Main Dashboard–>System–>Edit Personal Transcript Requests Default

Client Action Plan Templates

Use these Word and PDF Client Action Plans to pre plan what will be reviewed by the client during their tax preparation meeting or any follow ups. I recommend attaching any of the mentioned forms like 8821 or 2848, IRS Account Tracking Product:

Monitoring Taxpayers Best Practices

Analyzing THS Change Log

Instructions to view the change log (Video Below):

- When you open THS after you sign in.

- After any transcript request or mailbox download click “view changes”

- Tools–>View>View Account Changes

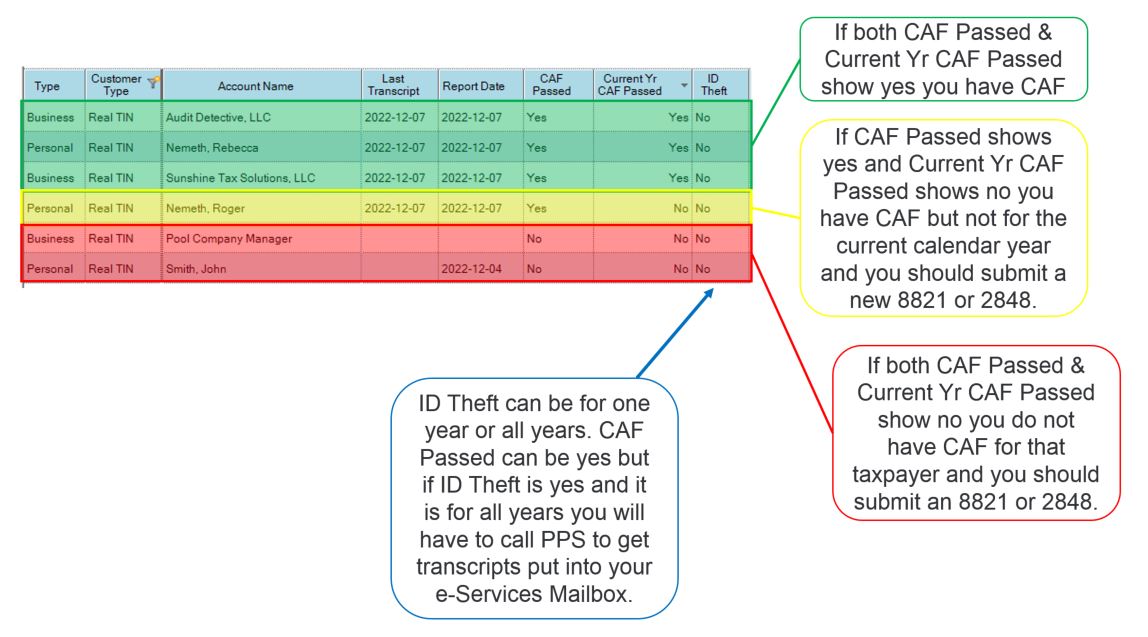

Events tracked in Change Log:

Finding Refund Opportunities

Instructions (Video Coming Soon):

- Review the Issues and Opportunities Report at Data Search–>Search Issues & Opportunities

- Review the Abatable penalties for First Time Abatement Opportunities at Data Search–>Search Abatable Penalties

Check For Underreported Income

Instructions (Video Below):

- Each individual taxpayer that has transcript in THS should have a Post Filing Income Verification Report in their dashboard

Video Identifying Underreported Income:

Mitigate An Audit

Instructions (Video Below):

- Once an audit is detected (not a CP2000) review the return transcript for possible audit risk.

- Primary focus is on the schedules and refundable credits.

- Notify the client and inform them the IRS is reviewing their return for possible audit and mitigate the results by submitting an amended return if there is an issue that can be fixed (potentially avoiding penalties). There are more details in the videos below.

Two Hour Complete Archived Webinar on how to detect and mitigate audits

Mitigate A CP2000

Instructions (Video Below):

- Once an AUR/CP2000 is detected from the audit flag in the change log or from the THS Post Filing Income Verification Report use the Post Filing Income Verification Report and IRS transcripts to determine the mismatch.

- Be advised that there can be false positives. Foreign Tax Credits and 1099-C mismatches are often false because the information about taxability is not in the return transcripts.

Quick CoPilot Video on detecting and mitigating AUR/CP2000

Coming Soon

One hour archived webinar on detecting and mitigating AUR/CP2000